Overview

Tax configuration ensures you collect the correct taxes on reservations. Set up tax profiles for different jurisdictions and apply them to properties automatically.

Common Tax Types

Occupancy Tax

Also known as lodging tax, hotel tax, or transient occupancy tax (TOT). Typically a percentage of the accommodation charge.

Sales Tax

State or local sales tax applied to short-term rentals in some jurisdictions.

Tourism Tax

Additional taxes used to fund local tourism initiatives.

VAT/GST

Value-added tax or goods and services tax for international properties.

Flat Fees

Per-night or per-stay flat tax amounts required by some jurisdictions.

Creating Tax Profiles

Navigate to Tax Settings

Go to Settings > Taxes.

Add Tax Profile

Click "Add Tax Profile" to create a new configuration.

Enter Profile Details

- Name - Descriptive name (e.g., "Miami Beach Taxes")

- Description - Notes about the tax jurisdiction

Add Tax Components

Add individual taxes to the profile:

- Tax Name - Name displayed on invoices

- Rate - Percentage or flat amount

- Type - Percentage or fixed fee

- Applies To - Accommodation only, or all charges

Assign to Properties

Select which properties should use this tax profile.

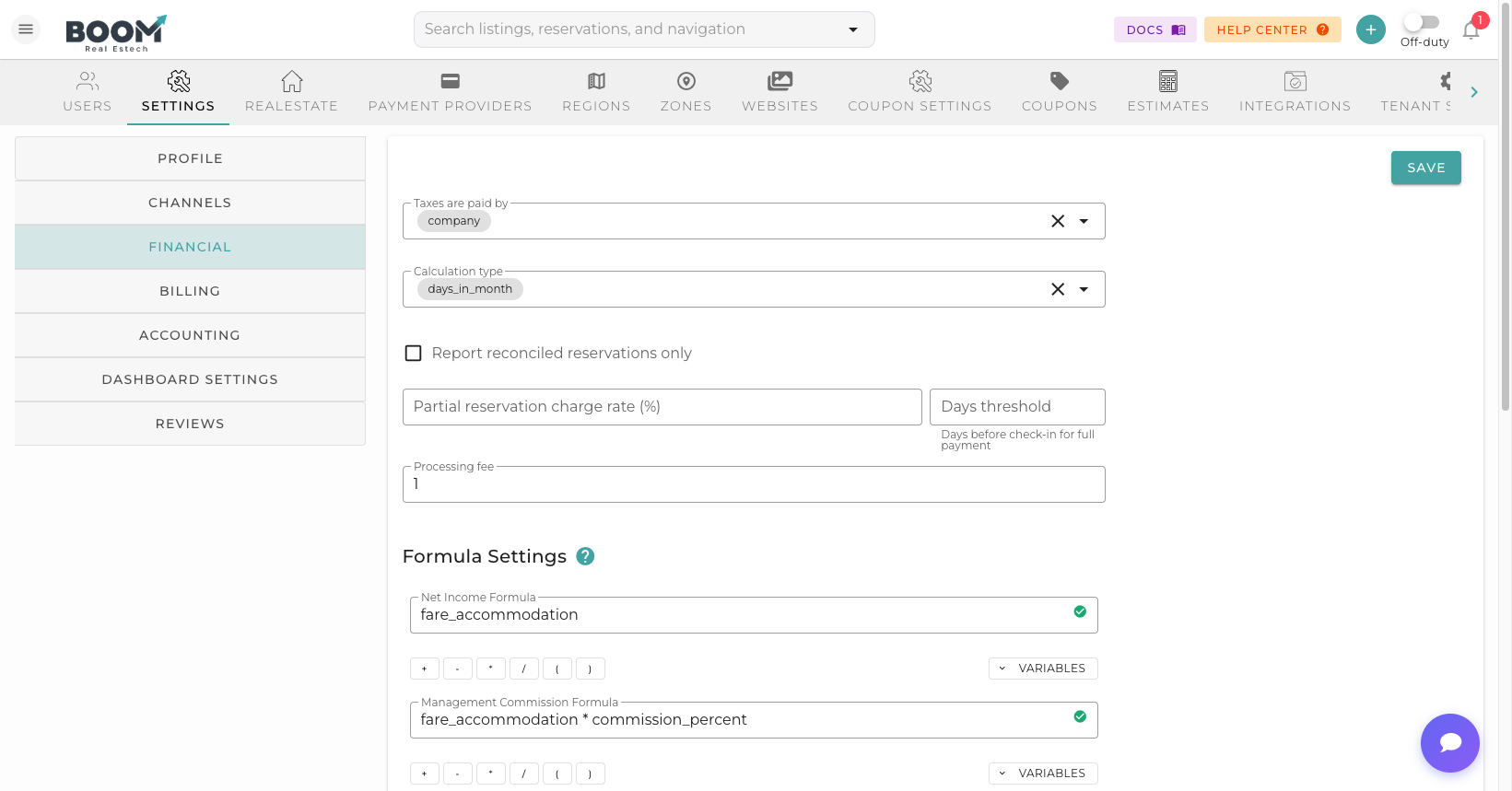

Tax Calculation Methods

Inclusive vs Exclusive

- Exclusive (default) - Tax added on top of the rate

- Inclusive - Tax included in the displayed rate

Calculation Base

- Accommodation Only - Tax on nightly rate only

- All Charges - Tax on total including fees

- Excluding Fees - Tax on accommodation, not cleaning fees

Tax Reporting

Generate reports for tax filing:

- Tax Summary - Total taxes collected by period

- Tax Detail - Breakdown by property and reservation

- Tax by Jurisdiction - Grouped by tax profile

- Export - Download for accountant review