The General Ledger: Complete financial transaction history

Overview

The Boom PMS ledger system provides a full double-entry accounting framework tailored for vacation rental businesses. It automatically records transactions from reservations, expenses, and payments while allowing manual entries for complete financial control.

Key features include:

- Pre-configured chart of accounts for vacation rentals

- Automatic transaction recording from reservations

- Manual journal entry capability

- Multi-property and multi-owner tracking

- Integration with external accounting software

Chart of Accounts

The chart of accounts organizes your financial data into standard accounting categories:

| Account Type | Description | Examples |

|---|---|---|

| Assets | What you own or are owed | Bank accounts, Accounts Receivable |

| Liabilities | What you owe to others | Security Deposits, Owner Payables |

| Income | Revenue from operations | Rental Income, Cleaning Fees, Management Fees |

| Expenses | Costs of running the business | Cleaning Costs, Maintenance, Utilities |

| Equity | Owner's stake in the business | Retained Earnings, Owner Equity |

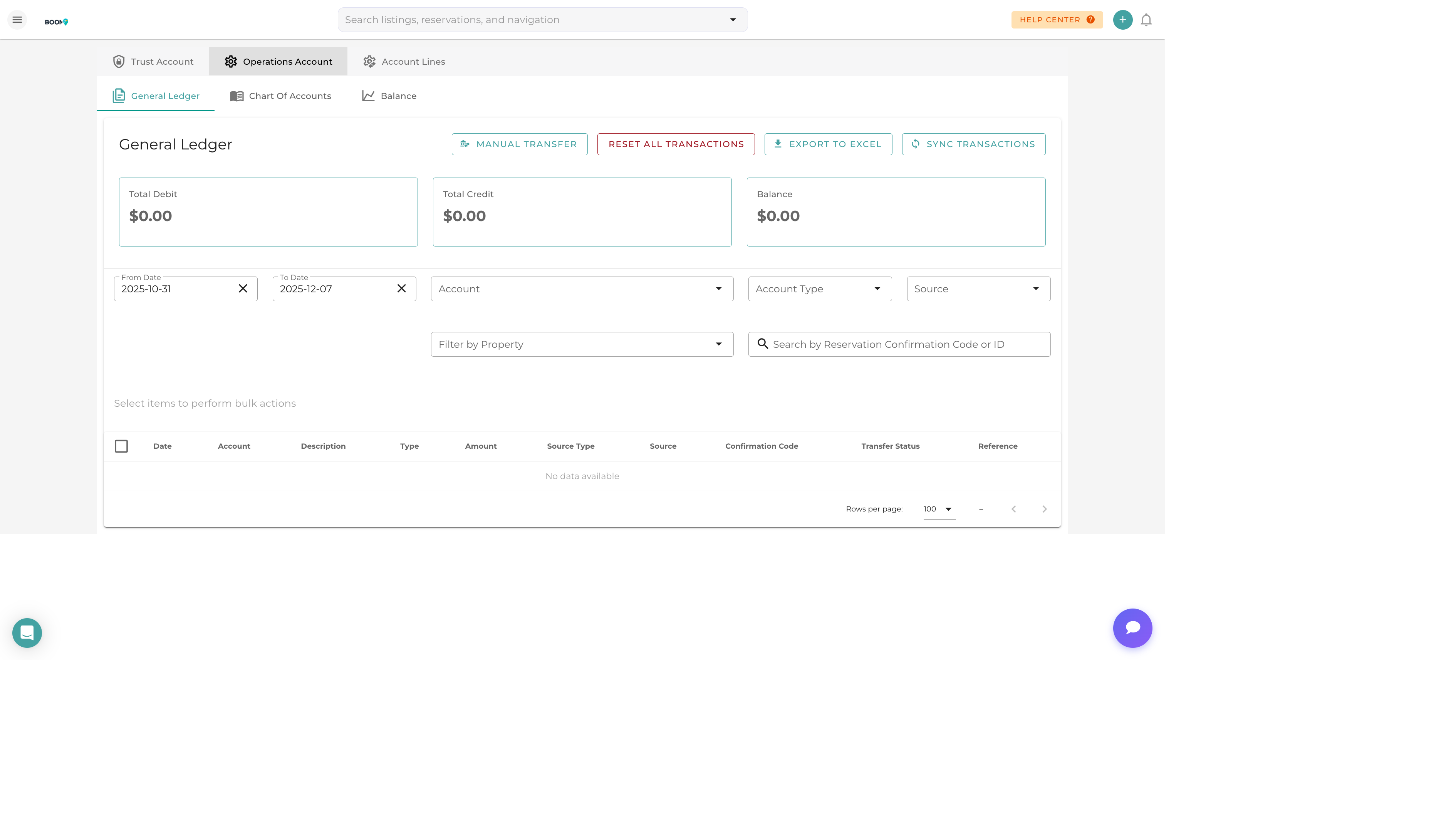

Viewing Transactions

Filter by Date Range

Use the date picker to select a specific time period. Common options include:

- This Month / Last Month

- This Quarter / Last Quarter

- This Year / Last Year

- Custom date range

Filter by Account

Select specific accounts to view their transaction history. You can filter by:

- Account type (Assets, Liabilities, etc.)

- Specific account name

- Property (for property-specific accounts)

Transaction Details

Each transaction shows:

- Date - When the transaction occurred

- Description - What the transaction is for

- Debit/Credit - The amounts and direction

- Balance - Running account balance

- Source - Where the transaction came from (reservation, expense, manual)

Pro Tips

Monthly Reconciliation

Review ledger balances monthly and reconcile with bank statements. This catches discrepancies early and keeps your books accurate.

Export for Accountants

Use the export feature to generate reports for your accountant. Choose CSV or PDF format based on their preference.

Avoid Editing Posted Transactions

Once transactions are posted to a closed period, avoid editing them. Use adjusting entries instead to maintain audit trail integrity.

Was this guide helpful?

Thanks for your feedback!